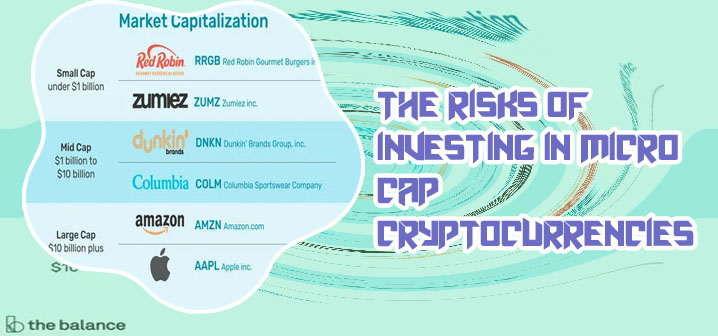

What is market cap in crypto

New Listed Cryptos

How is crypto market cap calculated

Coin Guides is a place for anything that is related to Bitcoin, Blockchain and Cryptocurrency. Since we started Coin Guides we’ve been posting so many tutorials and guides for crypto newbie’s. Also we are trying to improve this site by adding more new features. One feature which we recently implemented is crypto market cap where users can see cryptocurrency live charts while reading our guides and tutorials. Why is the circulating supply used in determining the market capitalization instead of the total supply? Tether’s price is anchored at $1 per coin. That’s because it is what’s called a stablecoin. Stablecoins are tied to the value of a specific asset, in Tether’s case, the U.S. Dollar. Tether often acts as a medium when traders move from one cryptocurrency to another. Rather than move back to dollars, they use Tether. However, some people are concerned that Tether isn’t safely backed by dollars held in reserve but instead uses a short-term form of unsecured debt.

Damus to lure in Crypto Twitter with Bitcoin revenue payout option

Why is market cap important in crypto

Sometimes, the security onus is on crypto holders who forget or lose their passwords/access keys, repressing millions of coins in addresses with no real use case. A study by the Wall Street Journal shows that 20% of all Bitcoin’s supply may be lost forever. At the current BTC price, investors are leaving more than $40B in invisible hands due to the lack of security measures. However, they are still contributing to the total market cap of the currency, inflating its value perception. To (Market) Cap It Off Price is the agreed transaction price from buyers and sellers in the market. It is the most intuitive value used for calculating profit and loss, rate of return and performance of the asset. It is a variable that will fluctuate everyday due to market activities.